Consider the figure below.

A price floor set above the equilibrium price is always be a binding price floor.

A binding price floor is a required price that is set above the equilibrium price.

This graph shows a price floor at 3 00.

The equilibrium market price is p and the equilibrium market quantity is q.

A price floor is a government or group imposed price control or limit on how low a price can be charged for a product good commodity or service.

If a price floor that is above the equilibrium price is imposed on a market and the government buys the surplus what will happen to consumer and producer surplus.

A price floor must be higher than the equilibrium price in order to be effective.

Another way to think about this is to start at a price of 100 and go down until you the price floor price or the equilibrium price.

Note that the price floor is below the equilibrium price so that anything price above the floor is feasible.

The latter example would be a binding price floor while the former would not be binding.

Look at the figure the market for milk.

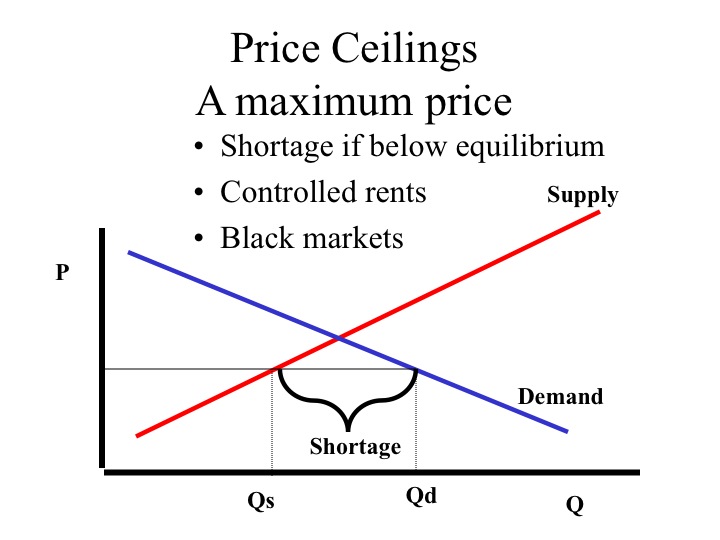

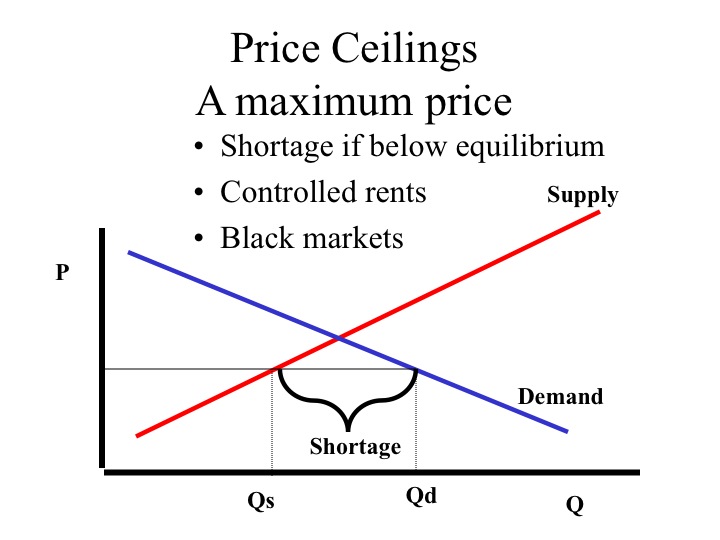

A price ceiling set above the equilibrium price is not binding.

If it s not above equilibrium then the market won t sell below equilibrium and the price floor will be irrelevant.

A price ceiling is a legal maximum price but a price floor is a legal minimum price and consequently it would leave room for the price to rise to its equilibrium level.

Nothing is preventing prices from rising so nothing will change.

Consumers are always worse off as a result of a binding price floor because they must pay more for a lower quantity.

A non binding price floor is set below the equilibrium price.

This changes nothing because at this price there is a shortage which drives prices up.

Drawing a price floor is simple.

This has the effect of binding that good s market.

The government is inflating the price of the good for which they ve set a binding price floor which will cause at least some consumers to avoid paying that price.

In this case the market price would serve as a rationing mechanism because the price floor would have no effect on the market.

A price floor set at 6 a price floor set at 6 would be non binding because it is a government mandated minimum price that is set below the equilibrium price.

A non binding price floor is one that is lower than the equilibrium market price.

If there were a binding price floor in the market for milk the price could be.

If the equilibrium price of gasoline is 3 00 dollars per gallon and the government places a price ceiling on the gasoline of 4 00 dollars per gallon the result will be a shortage of gasoline.

The equilibrium price commonly called the market price is the price where economic forces such as supply and demand are balanced and in the absence of external.

A minimum price set above the equilibrium price is a.